I made you a super helpful present! 💸

Hello, hello!

Pre-S: My email from last week asking what people’s thoughts were on auto-responders sparked some good conversations! Bottom line: I didn’t end up setting one up. I decided that no one but me cared. In the best way possible!

But anyway. Back to the point of the email.

I was chatting with a client last week and she mentioned that she had no real idea how to figure out how much to send to the IRS for estimated quarterly payments.

And I thought to myself, “Self, this will not do! We cannot leave our clients high and dry in this, their time of need!”

(Why did I switch to the “Royal We” and channel some weird fantasy rabble-rouser in this internal monologue? I have no idea, but I’m letting it stand. Brains, amiright?)

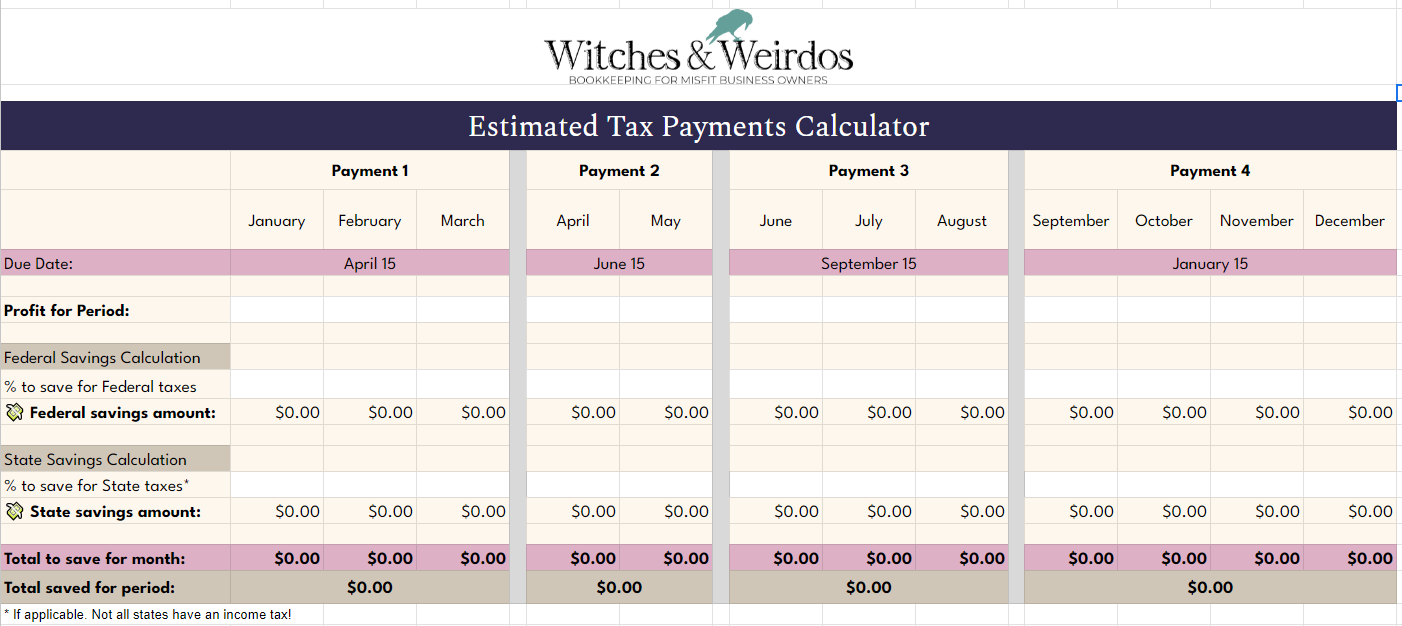

And so, I created an Estimated Quarterly Tax Payment Calculator.

Is it really just a simple spreadsheet? Yes, yes it is.

AND. Is it helpful to be handed a spreadsheet that’s already put together and specifically designed to do a thing you need help with?

YES. YES IT IS.

(Also, it’s pretty, don’t ya think?)

So if you’re interested in quickly and easily figuring out how much to set aside each month for estimated payments, you can get the calculator here. (Don't worry, it won't send you into any long sales funnel sequence or anything! 🤣)

And if you need a bit of guidance on what percentages to use, you can read about that here.

If you end up accessing it, let me know how you like it, or if you have any questions!

All the (consensual) money hugs,

P.S. The calculator is in Google Sheets and in read-only mode, so be sure to go to File -> Make a Copy to, well, make a copy and save it in your own Drive. Here's the link one more time to get it.